Your Best Banker Just Quit. Will the Next One Follow the Same Workflow?

Staff Turnover Is Inevitable. Revenue Loss Doesn’t Have to Be.

Employee attrition isn’t just an HR headache—it’s a frontline operations risk that threatens your bank’s edge in a competitive market. When seasoned bankers leave, they take more than their keycards. They take workflow familiarity, compliance shortcuts, and years of customer knowledge. This puts revenue, regulatory accuracy, and customer trust on the line—especially when community and regional banks are vying for the same customers with faster, more consistent service.

Why Turnover Hurts More in a Competitive Landscape

Community and regional banks face fierce competition not just from fintechs but from each other. Customers expect seamless experiences, and rivals are quick to capitalize on any misstep. A single delay or error caused by a new hire’s learning curve can push customers to a competitor down the street. According to the 2024 U.S. Retail Banking Satisfaction Study, 13% of customers say they probably or definitely will switch banks within the next year (J.D. Power, 2024). When your best bankers leave, the operational gaps they create give competitors an opening to win your customers.

Turnover Stats That Should Worry Every Bank Executive

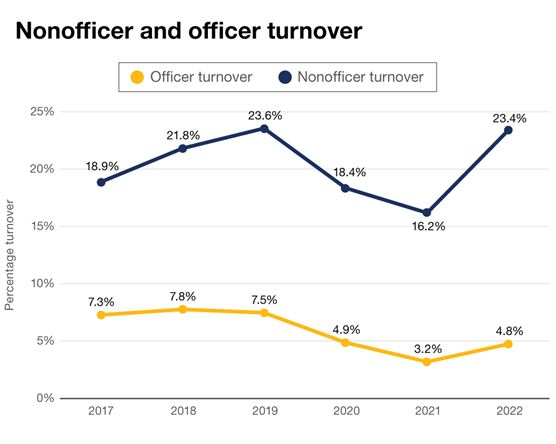

- 23.4% of non-officer employees and 6.5% of officers left banks in 2023

(Crowe LLP, 2023) - 52% of bank managers and 49% of frontline staff say they plan to leave within the year

(Zebra Technologies, 2024) - Replacing just one $45,000 banker can cost up to $90,000

(Payactiv, 2023)

The Operational Fallout of High Attrition

When onboarding takes months—and customer-facing mistakes take seconds—you don’t have time to hope new hires “figure it out.” Turnover creates vulnerabilities that competitors exploit.

Operational Weak Point

- Knowledge Gaps

- Long Ramps

- Data Entry Errors

- Customer Experience Dips

What Happens During Turnover

- New staff lack informal procedures and product familiarity

- It takes 3–8 months for bankers to reach full productivity

- Compliance-critical workflows are prone to human mistakes

- Delays and inconsistencies frustrate customers—and reduce trust

Technology Can’t Prevent Turnover—But It Can Prevent Chaos

Instead of relying on tribal knowledge and paper checklists, forward-thinking institutions are embedding intelligence into their workflows with SNAP, an intelligent workflow platform designed to streamline banking operations.

SNAP Turns Tribal Knowledge Into System Intelligence

SNAP Feature

- Guided Workflows

- Automated Error Prevention

- Embedded Knowledge

- Standardized Journeys

Attrition-Proofing Benefit

- New bankers get live step-by-step instructions for KYC, BOI, and onboarding

- Real-time checks eliminate critical account setup mistakes

- Best practices live in-system—not in someone’s head or outdated binder

- Customers get a consistent, compliant experience—every time

Case in Point: Training Time Isn’t Just a Cost—it’s a Risk

When you standardize your workflows, training new bankers takes hours, not weeks. That means fewer errors, faster onboarding, and a stable customer experience—even when your best people leave. Banks using SNAP have cut onboarding workflows from 45 minutes to under 10—and reduced hand-offs by over 70%.

Customer Success Story

One community bank opened over 200 accounts in just 9 days at a new branch—with only three tablets and a team that included bankers brand new to SNAP. Without it, they said, that kind of volume would’ve been impossible.

Another institution reported cutting account opening times from 30 minutes to just 5. Training that used to take a full week? Now done in days. One staff member put it simply:

“SNAP doesn’t allow what’s not needed—it guides you step by step.”

Banks also credit SNAP with reducing onboarding errors and streamlining compliance. One operations leader shared:

“We’re now 96% automated. It takes the guesswork out of Beneficial Ownership.”

And for training teams, the impact is just as clear:

“For the first time, we can focus on soft skills—not just how to click through a system.”

With SNAP, new bankers aren’t guessing. They’re performing—on day one.

Addressing Implementation Concerns

We know adopting new technology can feel daunting, especially with tight budgets and busy teams. That’s why SNAP offers phased rollouts to minimize disruption and hands-on training to ensure your staff is confident from day one. Our proven deployment process lets you integrate SNAP seamlessly, so you can focus on serving customers—not managing change.

Build a Team That Performs—Even When People Leave

You can’t stop people from moving on. But you can stop knowledge loss, performance dips, and regulatory exposure from going with them. With SNAP, every banker performs like your best banker—on day one. This resilience not only protects your bottom line but also strengthens your position against local competitors who are just as eager to win your customers.

Want to See How It Works?

We’ll show you exactly how SNAP embeds resilience into your in-branch processes—specifically if you’re on Jack Henry™ core platforms like SilverLake System®, CIF 20 / 20®.

Sources:

Crowe LLP. (2023, September 26). Even with increased compensation, banks are struggling to hire and retain talent. Crowe LLP. https://www.crowe.com/news/even-with-increased-compensation-banks-are-struggling-to-hire-and-retain-talent

J.D. Power. (2024, March 12). 2024 U.S. retail banking satisfaction study. https://www.jdpower.com/business/press-releases/2024-us-retail-banking-satisfaction-study

Payactiv. (2023, April 5). What is the cost of replacing an employee? https://www.payactiv.com/blog/cost-of-replacing-an-employee/

Woods, K. (2015). Exploring the relationship between employee turnover rate and customer satisfaction levels. The Exchange, 4(1). SSRN. https://ssrn.com/abstract=2676840

Zebra Technologies. (2024, March 12). Zebra banking survey finds half of employees may quit due to outdated tech. Zebra Technologies Investor News. https://investors.zebra.com/news-and-events/news/news-details/2024/Zebra-Banking-Survey-Finds-Half-of-Employees-May-Quit-Due-to-Outdated-Tech/default.aspx

More From Zelus

Trusted by Leading Banks