Why the Biggest Banks Are Doubling Down on Branches — and What Community Institutions Should Learn from It

TLDR

Major U.S. banks are investing billions in tech-enabled branches to maintain trust-based, face-to-face services. Community banks can compete by streamlining in-branch workflows with tools like Zelus' Simple New Account Platform (SNAP), achieving relational advantages without massive budgets.

Why Are Big Banks Betting on Physical Branches in 2025?

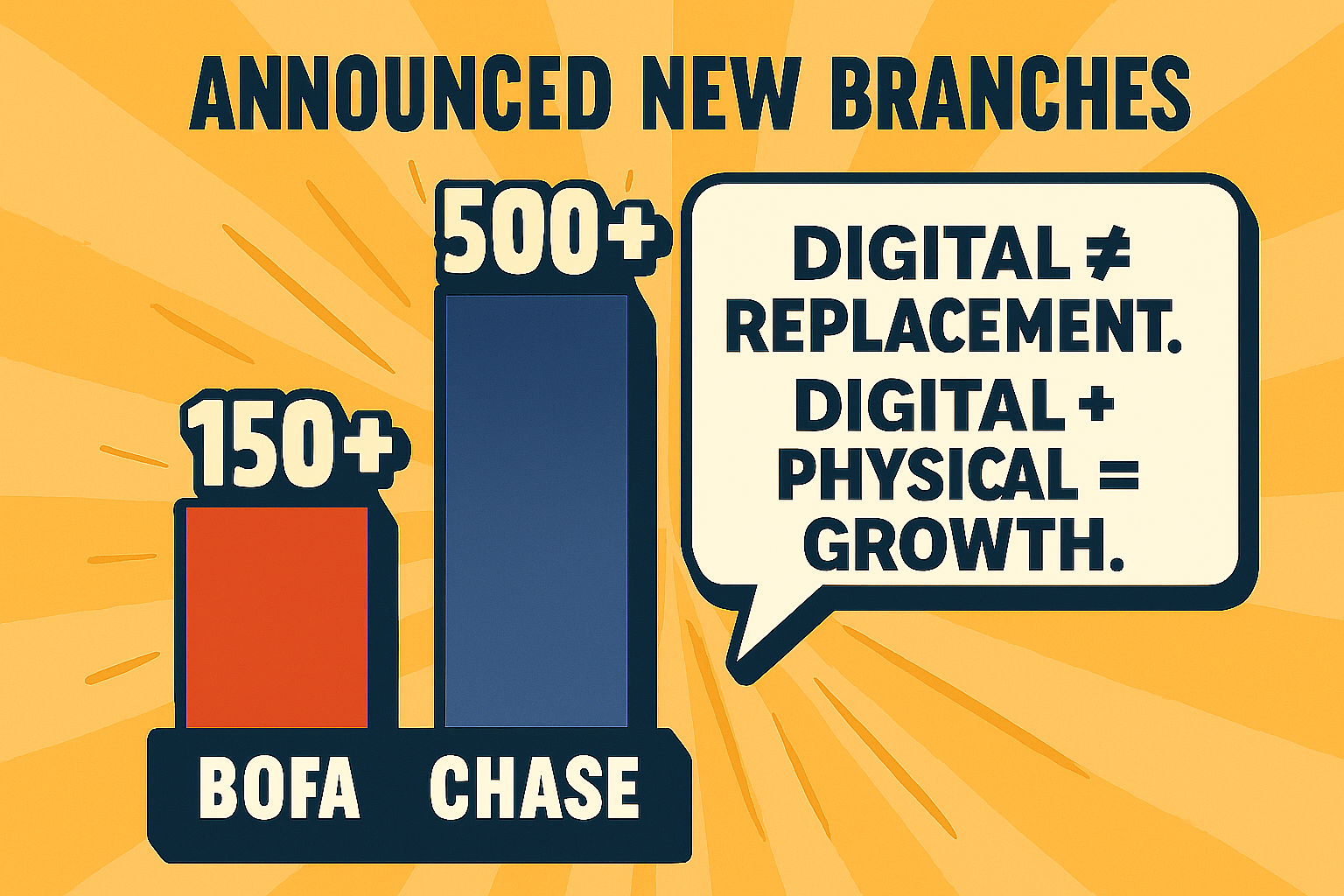

Despite a decade of "digital-only" predictions, physical bank branches remain critical for high-stakes financial decisions. According to Reuters, Bank of America plans to open over 150 new financial centers by 2027, while JPMorgan Chase aims to add 500 new U.S. branches and renovate 1,700 more in the same period. Notably, over 90% of Bank of America’s client interactions occur online, yet both banks view branches as essential for trust-building conversations, such as mortgage applications or business account setups. This trend reflects a broader industry shift: while digital banking dominates routine transactions, in-person interactions drive complex, high-value services.

The banking industry has seen a 17% decline in U.S. branches since 2012, per FDIC data, but the remaining branches are evolving into tech-enabled hubs. These modern branches blend digital tools with personal service, catering to customers who value both convenience and human connection. For community banks, this presents an opportunity to compete with larger institutions by adopting similar technologies without billion-dollar budgets.

Key Takeaway: Physical branches are not obsolete—they’re evolving into tech-driven relationship centers, and community banks can leverage this trend to stay competitive.

How Do Physical Branches Complement Digital Banking?

Physical branches enhance digital banking in four key ways, making them indispensable for both large and community banks:

- Trust Accelerator: Face-to-face meetings with advisors build confidence that apps can’t replicate. A 2023 J.D. Power study found that 65% of customers prefer in-person consultations for complex financial decisions like mortgages or retirement planning.

- Cross-Sell Engine: In-person interactions uncover broader customer needs, such as wealth management, insurance, or treasury services, driving revenue. For example, a customer visiting for a business account might also explore investment options.

- Brand Billboard: Modern branches serve as marketing showcases and community hubs, reinforcing brand identity. A sleek, tech-enabled branch signals innovation and reliability.

- Tech Playground: Smart ATMs, tablets, and video chat systems allow staff to demonstrate digital tools live, bridging the gap between physical and online banking.

For community banks, these benefits are critical to competing with fintech and large banks. By optimizing branch experiences, smaller institutions can build loyalty and attract local customers.

Search Intent: If you’re wondering, “Why are bank branches still relevant in 2025?” The answer lies in their role as trust-building, revenue-driving hubs that complement digital platforms.

What Challenges Do Community Banks Face in Branch Operations?

Community banks often struggle with inefficiencies that hinder their ability to deliver seamless in-branch experiences. A frontline customer service representative (CSR) at a midsize Midwest bank noted, “Opening a business account takes 45 minutes—if we don’t re-key the data twice.” Common friction points include:

- Redundant Data Entry: Staff manually input data across core banking systems, CRMs, and imaging platforms, wasting time and increasing errors.

- Manual ID Capture: Scanning IDs and documents is time-consuming and prone to mistakes.

- Complex Account Titling: Setting up trusts, HSAs, or LLC accounts often leads to errors due to outdated processes.

- Staff Training: Seasonal or part-time staff require lengthy training, slowing onboarding and service delivery.

These inefficiencies frustrate customers and staff alike, undermining the trust that branches are meant to foster. However, technology like SNAP can address these pain points, enabling community banks to compete with larger players.

Pro Tip: Conduct a workflow audit to identify bottlenecks in high-value processes like account opening or mortgage applications. This is the first step to modernizing your branch.

How Does SNAP Transform Community Bank Branches?

The Simple New Account Platform (SNAP) is a low-code solution designed to streamline in-branch workflows, empowering community banks to deliver fast, error-free services. SNAP’s key features include:

- Rapid Account Opening: Open consumer or business accounts in under 10 minutes, compared to the industry average of 30–45 minutes.

- CIF Records: Cut duplicate data entry with smart CIF pre‑fill—DL scan populates the essentials in seconds.

- Seamless Integration: Capture e-signatures, IDs, and forms directly into Synergy, ensuring compliance and efficiency.

- Instant Paperwork Delivery: Email compliant documents to customers instantly, reducing wait times.

- Error Reduction: Cut onboarding errors by 90%, boosting customer satisfaction and trust.

- Fast Staff Training: Train new hires in under 4 hours, compared to 20+ hours for legacy systems.

A 2024 case study by Zelus Automation showed that a community bank using SNAP reduced account opening time by 75% and increased customer satisfaction scores by 20%. By adopting SNAP, community banks can deliver big-bank efficiency while maintaining a local, personal touch.

Strategic Steps for Community Banks to Compete in 2025

To leverage the branch renaissance and compete with larger banks, community banks should take these actionable steps:

- Audit High-Value Journeys: Analyze key processes like mortgage applications and business account onboarding to identify inefficiencies. Use tools like customer journey mapping to pinpoint friction points.

- Map Digital-to-In-Person Hand-Offs: Ensure seamless transitions between online and in-branch interactions. For example, allow customers to start an application online and complete it in-branch with SNAP.

- Adopt Low-Code Tools: Replace legacy workflows with platforms like SNAP to streamline account opening and document management. This reduces costs and improves efficiency.

- Train Staff for Advisory Roles: Shift staff focus from transactional tasks to relationship-building conversations. SNAP automation frees up time for personalized advice.

- Market Branches as Relationship Hubs: Promote branches as community-focused centers for financial guidance, not just cash transactions. Use local SEO and social media to highlight events like financial literacy workshops.

Local SEO Tip: Optimize Google Business Profiles for each branch with accurate NAP (Name, Address, Phone Number) details, photos, and customer reviews to boost local search visibility.

Why Local SEO Matters for Community Banks

With 60% of web traffic coming from mobile devices and searches like “bank near me” surging by over 60% in the past two years, local SEO is critical for community banks. Here’s how to optimize:

- Claim Google Business Profiles: Ensure each branch has a complete, updated profile with hours, services, and photos. Encourage positive reviews to boost rankings.

- Use Local Keywords: Incorporate terms like “best bank in [City]” or “community bank [Neighborhood]” in blog posts, meta descriptions, and landing pages.

- Create Local Content: Publish blog posts about community events or financial tips tailored to your region (e.g., “Homebuying in [City]”).

- Build Local Backlinks: Sponsor local events or partner with community organizations to earn backlinks from local blogs or news outlets.

Example: Community banks that implement branch-specific pages with localized keywords, highlight community involvement, and maintain updated Google Business Profiles often see measurable improvements in search visibility—and a corresponding increase in in-branch visits.

FAQ: Your Questions About Bank Branches in 2025

Are bank branches still relevant in 2025?

Yes. While 90% of routine interactions are digital, customers prefer in-person advice for complex decisions like mortgages or business accounts, according to J.D. Power.

Why are Bank of America and Chase opening new branches?

They see branches as trust-building hubs for profitable products. Bank of America plans 150+ new branches, and Chase aims for 500+ by 2027, according to Reuters.

How can community banks compete without big budgets?

By modernizing workflows with platforms like SNAP, community banks can reduce errors, speed up account opening, and focus on advisory relationships.

How does SNAP improve branch efficiency?

SNAP cuts account opening time to under 10 minutes, reduces errors by 90%, and trains staff in 4 hours, making branches more efficient and customer friendly.

What’s the role of local SEO for banks?

Local SEO ensures branches appear in searches like “bank near me,” driving foot traffic. Optimizing Google Business Profiles and local content is key.

Final Thoughts: Leveling the Playing Field with SNAP

As major banks like Bank of America and JPMorgan Chase invest billions in tech-enabled branches, community banks can compete by adopting tools like SNAP. By streamlining workflows, reducing errors, and focusing on relationships, community banks can deliver big-bank efficiency with a local touch. Combine this with a robust local SEO strategy—optimized Google Business Profiles, local content, and backlinks—and your bank can dominate regional searches and attract loyal customers.

Ready to Modernize the Most Important Workflow in Banking?

Book a 15-minute discovery call at https://www.zap-llc.com/contact-us

Or email us at sales@zap-llc.com

More From Zelus

Trusted by Leading Banks